Nigerian‑founded Flutterwave last week rolled out its digital payment services in Cameroon, following regulatory approval from the Central Bank of Central African States (BEAC). In partnership with pan‑African lender Ecobank, the fintech firm is now enabling Cameroonian merchants and entrepreneurs to accept and process payments seamlessly in local currency.

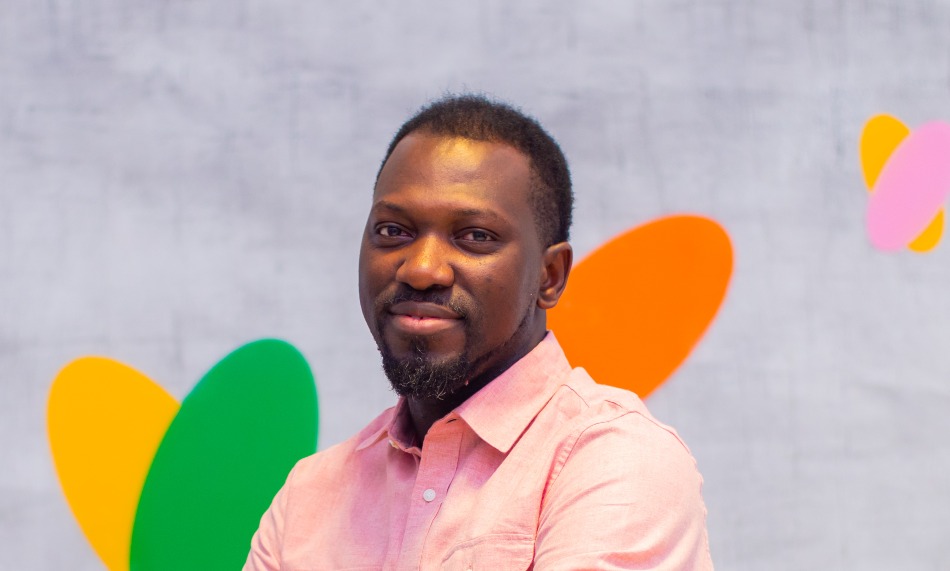

At a press briefing in Yaoundé, Flutterwave’s Founder and CEO, Olugbenga Agboola, said the move reflects the company’s ambition to bolster Africa’s digital economy. “Cameroon holds a central place in the future of Africa’s digital transformation,” Agboola remarked. “By offering secure, compliant and accessible payment solutions, we’re creating opportunities for businesses of all sizes—from local market vendors to international brands—to grow and thrive.”

BEAC’s green light came after Flutterwave formalized its ties with Ecobank Cameroon, leveraging the bank’s existing infrastructure and compliance framework. This collaboration fast‑tracked licensing and ensured that merchants can integrate Flutterwave’s platform without delay.

For many Cameroonian SMEs, digital payments have remained out of reach—until now. Flutterwave’s suite includes instant payment links shareable via WhatsApp and social media, settlement in Central African CFA francs, and an easy‑to‑use dashboard for tracking sales and refunds. Businesses can now accept card payments, mobile money transfers and cross‑border remittances through a single interface.

Industry analysts view Flutterwave’s expansion as a key step toward a unified pan‑African payments network. “This launch demonstrates that regulatory cooperation is possible and paves the way for frictionless trade across borders,” said Dr. Léa Ndoye, a fintech researcher at the African Economic Institute. “As more markets open, we’ll see momentum build for a truly cashless continent.”

Flutterwave’s entry is likely to spur rival platforms to accelerate their own rollouts in Central Africa. By raising the bar on compliance and user experience, the company is setting a new standard that could fuel broader innovation—from micro‑lending apps to digital savings tools—and create jobs in tech and finance.

With Cameroon now live on Flutterwave’s network, observers expect further launches across the BEAC zone—beginning with Gabon and the Republic of the Congo later this year. As digital payments take root, businesses large and small stand to gain from faster transactions, reduced cash handling and access to regional e‑commerce opportunities.

For Cameroon’s entrepreneurs, Flutterwave’s arrival signals the dawn of a more connected, efficient and inclusive financial landscape—one where the tap of a phone unlocks new possibilities.