Managing money isn’t always easy… especially when it doesn’t seem like there’s enough to go around. Bills, rent or mortgage payments, living expenses, and the rising cost of gasoline can all make your money appear to vanish before you’ve even had a chance to count it; you’re then left holding the bag when your children or even your spouse comes to you seeking a few dollars to help them get by.

This is where creating a household budget can be a lifesaver. By creating a budget, and learning personal tips, you can better see where your money is going and where it needs to go. Pay attention to the following tips:

Prepare Your Family Budget

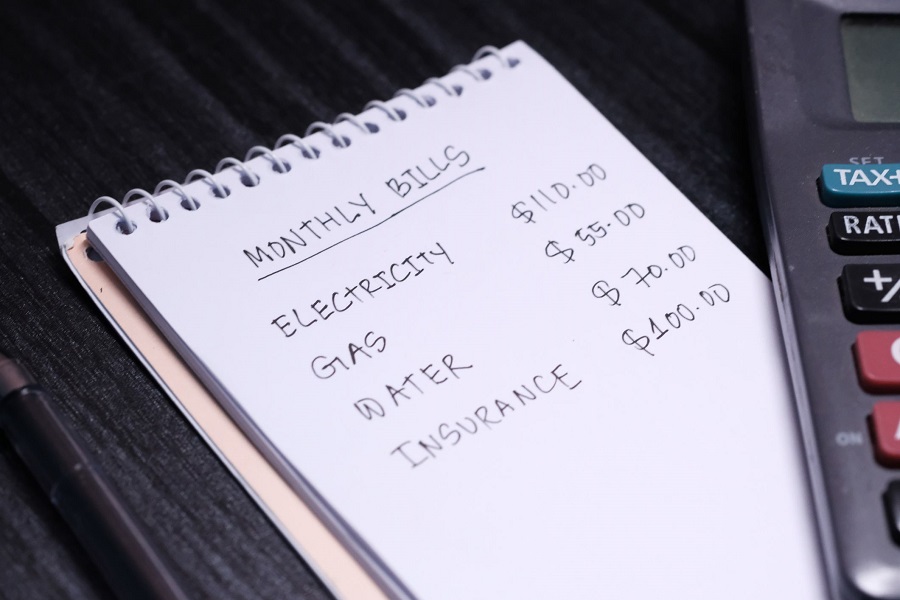

- Prepare the documents. Collect your monthly bills, as well as pay stubs and any other receipts that track regular income or expenses. You will need to be aware of all the money that comes into and goes out of the home. Having these items right in front of you will give you all the information you need.

- The household’s monthly income. Once you’ve compiled all of this information, begin adding up pay stubs and income receipts for all contributing members of your family or household. This will help determine how much money you have coming in each month. Make sure to account for all income including funds from investments, child support and disability or other such items.

- Add up the monthly expenses. Begin adding up your various bills and expenses. Make notes as to whether the examples you’re figuring in are high, low, or about average. This will allow you to see when there are spikes so that you can create an average based on the highest and lowest bills. Allocating a little extra for your regular expenses can help to make sure that everything gets paid, even when one or two bills are a bit higher than usual.

-

- Make sure to account for the necessities. Calculate the approximate amount that you spend on food and other essential products for the home. As before, adding a little extra to this amount can help to make sure that you don’t have to do without.

- Make note of items with fluctuating prices. Start figuring out how much you tend to pay for gasoline and other fuel or transportation expenses each month. Be sure to keep in mind the changes in costs over the past few years. You may need to adjust your budget monthly when costs are on the rise.

- Add the extras. Determine how much you generally spend on other expenses, including entertainment and non-essential services.

- The Unforeseen. It happens to everyone. An expense that you are not expecting. This can come in the form of an automobile repair or medical expense due to sudden illness. Without a budgeting process, many people are unprepared for times like these and it places a strain on the household finances. This does not have to devastate the monthly budget, however. You should set a monthly allowance for these expenses. Place this money into a “No Touch” savings account and it will be there when needed.

Set Up a Budget

- Put it on paper. Once you’ve figured out the various aspects of the budget, either make a physical copy of the budget on paper or use budgeting tools such as home budget software on your computer. You should also be sure to post a copy or printout of your family budget somewhere in the home so that all of the family can see it. If you are feeling industrious, you might even use a dry erase board so that changes can be made on the fly and comments can be added by different family members. This will allow all of you to work on how you budget money that is coming into the household.

- Get in the black. Compare the total income to the total expenses. If your household expenses are higher than household income, start looking at options for reducing certain expenses. The more you can lower these, the more you’ll be able to use the saved money elsewhere.

- Start saving some money. If you have more income than you do expenses, create allocations for savings or incidental funds. This can help prevent impulse spending while creating a funding buffer for your household. You can place this money into a savings account or invest in an IRA.

Learning these techniques will help you when setting up a family budget planner. Your budget won’t make you suddenly have more money. If used properly, however, it can help you to limit unnecessary expenses and let you know exactly how much you can afford to spend on non-essential items. A family budget can even help you to set up savings for the future and establish habits in your children that can assist them later in their lives.