Bitcoin’s price can be highly volatile, with significant fluctuations occurring over short periods. A well-thought-out strategy helps investors manage this volatility. At the same time, implementing effective investment tactics helps reduce inherent risks, including regulatory uncertainty, technological vulnerabilities, and frequent market sentiment swings.

There’s no such thing as a 100% winning strategy. However, by diversifying their investment portfolio, conducting thorough research, staying informed about recent market developments, and exercising discipline, crypto enthusiasts can enhance their chances of success and invest with more confidence, hoping for massive returns in the future. Read on for more.

Before You Start: Choose the Right Tool

In the ever-changing landscape, timing is everything. As an investor, you have to react fast and adapt to changing circumstances. The reality is that you can wake up one day and find out the price of Bitcoin surged by 12% just to realize its value dropped by 15% or 20% the next day. It’s not the most realistic scenario, but it could happen.

Because of that, it is of utmost importance to have the right tools to help you react on the spot if such a scenario occurs. If you’re working remotely and spend most of your time at home, having an online Bitcoin wallet is probably the best option. Still, this doesn’t guarantee you can react quickly once you see the news.

As a result, the best way to ensure you can react in time is by having a Bitcoin payment app from a trusted and reputable crypto exchange. This type of app typically offers real-time price alerts, instant buying and selling capabilities, and secure storage for your Bitcoin holdings, allowing you to execute transactions and manage your trades from anywhere swiftly. Finally, it’s vital to understand this is not an investment strategy by definition. However, such an approach ensures you stay ahead of market movements and seize opportunities as they arise.

Strategy #1 Buy and Hold (HODL)

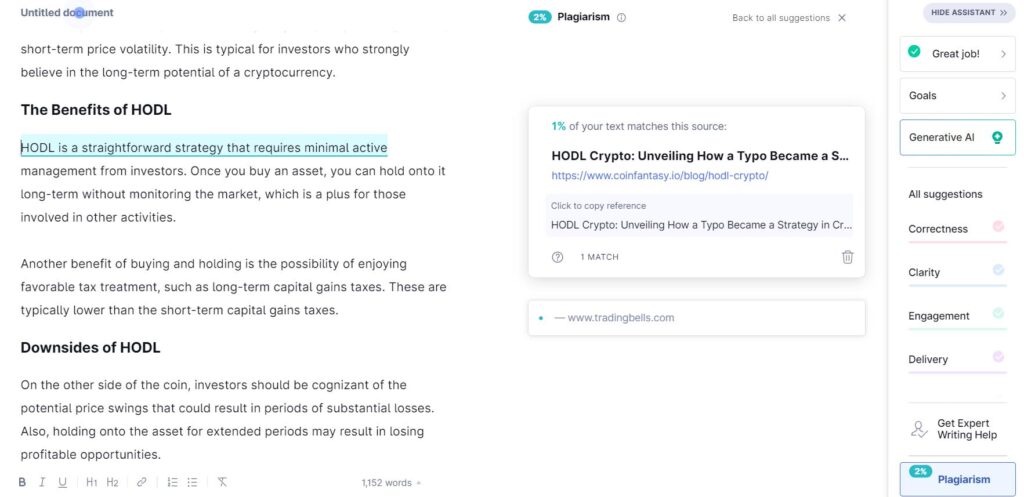

Buy and Hold is a strategy associated with long-term investing and is often applied to assets such as stocks, real estate, and cryptocurrencies, including Bitcoin. When it comes to the crypto community, this investment scenario is typically known as HODL, a term derived from a misspelled word “hold” in a Bitcoin forum post in 2013.

HODLing refers to holding onto an asset, in this case, Bitcoin, for an extended period of time, most commonly for years, despite the (possible) short-term price volatility. This is typical for investors who strongly believe in the long-term potential of a cryptocurrency.

The Benefits of HODL

HODL is a straightforward strategy that requires minimal active management from investors. Once you buy an asset, you can hold onto it long-term without monitoring the market, which is a plus for those involved in other activities.

Another benefit of buying and holding is the possibility of enjoying favorable tax treatment, such as long-term capital gains taxes. These are typically lower than the short-term capital gains taxes.

Downsides of HODL

On the other side of the coin, investors should be cognizant of the potential price swings that could result in periods of substantial losses. Also, holding onto the asset for extended periods may result in losing profitable opportunities.

Strategy #2 Strategic Rebalancing

Strategic rebalancing involves periodically adjusting the allocated assets, in this case, Bitcoin. This allows investors to maintain desired risk levels, investment objectives and target asset allocations.

The main idea is to use buying and selling to bring the portfolio back to the target allocation. For example, if you buy one Bitcoin that outperforms by increasing its value by 10%, you sell the difference and allocate those extra funds across other digital assets.

This way, you keep your portfolio close or at its target while enjoying the opportunity to earn extra profit if other assets you previously invested in outperform in the crypto market.

As a result, you not only have a decent risk-management strategy but also potentially benefit from diversifying your portfolio, which could bring significant future advantages. However, remember that there’s no guarantee that this strategy will work in your favor.

Strategy #3 Staking

Bitcoin staking is the process of holding BTC in a crypto wallet or a staking platform to support network operations on a proof-of-stake (PoS) mechanism. However, since Bitcoin does not operate on PoS but on proof-of-work (PoW), which differs from Ethereum or Cardano, it is impossible to stake Bitcoin as the cryptos mentioned earlier.

Instead, you can find projects and platforms that offer a sort of “wrapped” or derivative versions of Bitcoin that can be staked in PoS networks, like Ethereum. These derivatives include WBTC or renBTC, which are built on the Ethereum network.

One of the advantages of staking Bitcoins in this way is the potential rewards that come from supporting the network’s operations. Also, holders can benefit from potential capital appreciation of the staked cryptocurrency, whether renBTC, WBTC or any other Ethereum-based Bitcoin derivatives, if their value increases in time. At the same time, this strategy doesn’t save your crypto portfolio from market volatility.

Important: Risk Management

Considering this cryptocurrency’s inherent volatility, a careful risk management strategy could be crucial in Bitcoin investments. But before we dig in deeper into the subject, a small disclaimer: risk management is not an investment strategy per se, but it’s rather a fundamental part of every investment tactic, whichever you may choose.

Every investor should understand the potential risks that come with crypto investments, and this includes several aspects such as:

- Market volatility

- Regulatory uncertainty

- Technological vulnerabilities

- Security risks

For this reason, it is imperative to conduct thorough research and due diligence before investing, not just in Bitcoin but in any other digital asset. Stay informed about the latest market developments, and make sure to follow the news and trends that could impact the broader cryptocurrency market and the price of Bitcoin as a result.

Therefore, investors should use stop orders and adjust the platform to automatically sell their holdings if the Bitcoin price falls below a predetermined level, which should depend on their own risk assessment.

You should avoid impulsive decisions based on short-term price movements or market speculation, thus avoiding falling under the influence of the market sentiment. Finally, here’s the golden rule of investing – never spend more than you can afford.

Conclusion

Cryptocurrencies, or better say, Bitcoin, offer immense earning potential. However, becoming a millionaire overnight is (almost) not an option since this type of luck is reserved for a very few. Instead, you should rely on your knowledge, guts and other investors’ experiences.

When it comes to experiences, they say the best option is to buy Bitcoin and hold it for a longer period of time. This way, you can expect its value to surge once it reaches a more massive adoption and profit from the price difference. Along the process, you could review your portfolio and make smaller adjustments by allocating funds to other crypto assets.

Compared to other cryptos like Ethereum, staking Bitcoin is a bit more complex, but not impossible and certainly is not any less profitable. However, you should bear in mind that investing is more challenging than it seems and requires thorough research backed by a solid understanding of market conditions. Follow the latest news and trends and never spend more than you can afford, and you should be good to go.