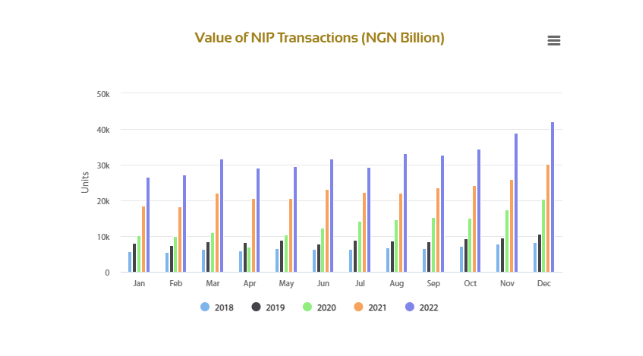

Electronic payment transactions in Nigeria rose to N387 trillion in 2022, hitting an all-time high as more Nigerians embrace cashless payments.

According to the data released by the Nigeria Inter-Bank Settlement System (NIBSS), the value recorded on the NIBSS Instant Payment (NIP) represents a 42% increase over the N272 trillion recorded in 2021.

While the e-payment data showed a steady increase throughout the 12 months of the year, the highest value was recorded in December. Being a festive period with lots of spending activities, Nigerians spend a total of N42 trillion over electronic channels in December 2022. This came as the all-time high monthly record on the NIBSS electronic payment platform.

The volume of transactions processed by NIBSS for the year also jumped from 3.4 billion in 2021 to 5.1 billion in 2022. This represents a 50% increase year on year.

Further surge anticipated: While the cashless policy of the Central Bank of Nigeria (CBN) is already gaining traction with many Nigerians getting used to mobile transfers, paying with PoS, and USSD, among others, the revised cashless policy, which is further limiting the amount of cash that can be withdrawn by individuals and corporate organisations will further drive a surge in electronic transactions across the country.

- According to the new policy which followed the redesigning of N1,000, N500, and N200 notes, effective from January 9, 2023, cash withdrawal by an individual will be limited to N500,000 a week, while corporate organisations have a N5 million withdrawal limit in a week.

- The apex bank said it will also limit the amount of cash in circulation effective from January 31, when the current old notes will cease to be legal tender. This will force many Nigerians to use electronic channels for payments.

About NIBSS NIP: The NIBSS Instant Payments (NIP) is an account-number-based, online real-time Inter-Bank payment solution developed in the year 2011 by NIBSS. It is the Nigerian financial industry’s preferred funds transfer platform that guarantees instant value to the beneficiary.

According to NIBSS, over the years, Nigerian banks have exposed NIP through their various channels, that is, internet banking, bank branch, Kiosks, mobile apps, Unstructured Supplementary Service Data (USSD), POS, ATMs, etc. to their customers.