Equity-focused funds have demonstrated superior performance compared to fixed-income-based funds within Nigeria’s thriving mutual funds industry, valued at N1.87 trillion.

Based on data analyzed by Nairametrics, a significant number of equity-based funds achieved returns that surpassed the inflation rate during the first half of the year.

These funds represent collective investment schemes that primarily target Nigeria’s stock market.

The Security and Exchange Commission, responsible for monitoring and reporting on the mutual fund markets, identifies 134 such funds currently operating in the country.

Fund Performance

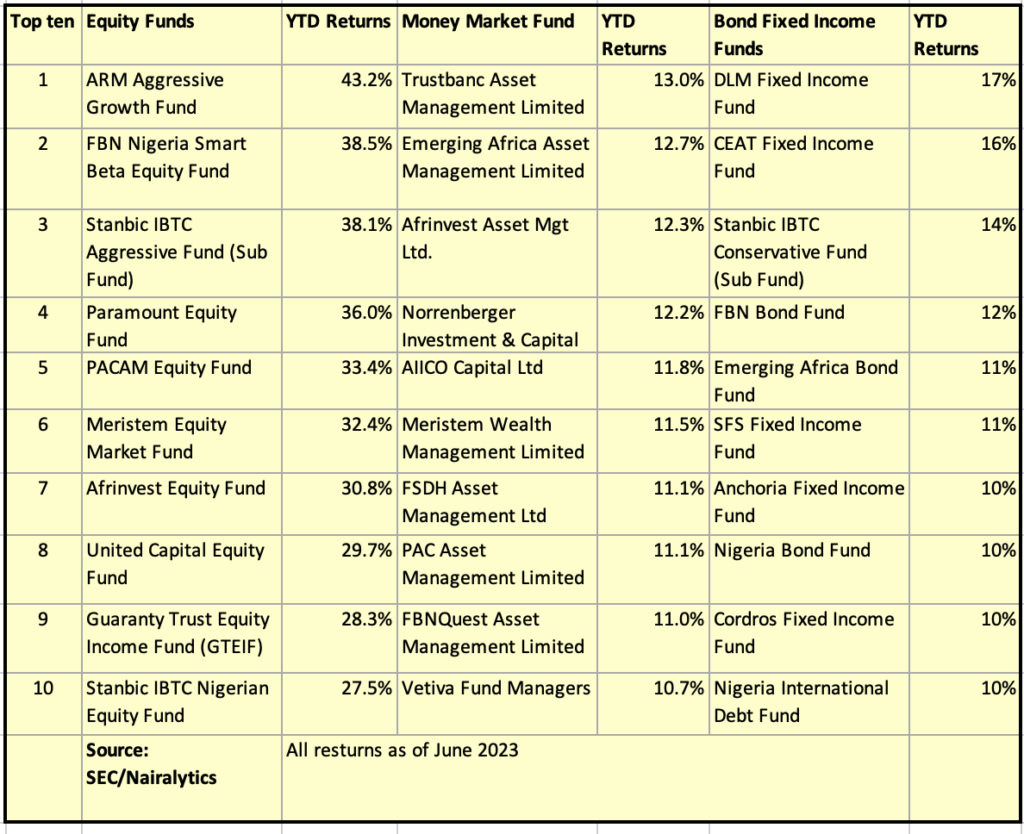

Equity-Based Funds: Among these funds, 16 are categorized as equity-based, boasting a combined net asset value of N20.5 billion. Impressively, all of these funds recorded double-digit year-to-date returns.

- For instance, the ARM Aggressive Growth Fund exhibited the most remarkable performance in the first half of the year, reporting an impressive 43.17% year-to-date return as of June 2023.

- Following closely, the FBN Nigeria Smart Beta Equity Fund secured the second position with a return of 38.36%, while the Stanbic IBTC Aggressive Fund (Sub Fund) achieved a commendable 38.1% return.

- In addition to the previously mentioned funds, the Paramount Equity Fund and the PACAM Equity Fund secured positions within the top 5 performing equity-based funds, achieving returns of 36.0% and 33.4% respectively.

- Out of the 16 equity-based funds listed, all except one generated double-digit returns solely in the first six months of the year.

The impressive performance of the equity-based funds is aligned with the overall performance of Nigeria’s Equities market, exemplified by the NGX All Share Index, which has experienced a remarkable 23% year-to-date gain, reaching the second-highest index point ever recorded at 63,040.

Money Market Funds: Relative to other types of funds, equity-based funds have demonstrated superior performance, closely following the exceptional performance of the equities market.

- For instance, the best-performing money market fund, Trustbanc Money Market Fund, achieved a 13% return. Stanbic IBTC Money Market Fund, with a net asset value of N348.5 billion, and FBN Money Market Fund, with a net asset value of 194.9 billion, posted year-to-date returns of 10.5% and 11.02% respectively.

- ARM Money Market Fund and AXA Mansard Money Market Fund, with net asset values of N79.8 billion and N40.7 billion respectively, generated returns of 9.6% and 9.27%.

- However, it is worth noting that the value of equity-based funds pales in comparison to fixed-income funds, which seem to be favored by conservative fund managers.

- These managers often prioritize the fees generated from managing larger funds over the relatively modest returns associated with fixed-income investments.

The Money Market Funds, with a total net asset value of N817.5 billion, constitute approximately 43.6% of the overall N1.9 trillion mutual fund market.

Other Funds: Bond/Fixed Income Funds, on the other hand, hold a value of N327.5 billion.

- Dollar mutual funds, which primarily invest in Eurobonds and fixed-income dollar-based securities, are valued at N550.5 billion.

- Among these funds, the PACAM Eurobond Fund achieved the highest returns at 13.58%. The fund’s net asset value stands at approximately N1.3 billion.

- Surpassing equity-based funds, real estate funds boast a value of N36.2 billion. UPDC REIT emerged as the top performer within this category, delivering an impressive 25% return.

- The fund’s net asset value is recorded at N26.8 trillion.

In addition to equity-based funds, Exchange Traded Funds (ETFs) exhibited exceptional performance in terms of year-to-date returns.

Notably, VCG ETF, VETBANK ETF, Meristem Value ETF, and SIAML ETF 40 achieved impressive returns of 52%, 51.7%, 49%, and 39.6% respectively.

However, despite their remarkable performance, the collective net asset value of these ETFs remains relatively modest, amounting to just N8.7 billion.

Source: nairametrics