First Bank of Nigeria Limited, Nigeria’s premier and leading financial inclusion services organisation has announced its partnership with Nigeria Inter-Bank Settlement System plc (NIBSS) on its recently launched Nigeria Quick Response (NQR) Payment Solution.

The NQR is an innovative payment option implemented for all financial service providers and designed to promote quick and fast transactions by scanning the code on one’s mobile device. Also, the initiative reduces cost(s) for merchants and banks in delivering instant value for person to business (P2B) and person to person (P2P) transactions by simply scanning to pay. Unlike other QR schemes, the NQR is implemented with reduced charges that is cheaper for merchants.

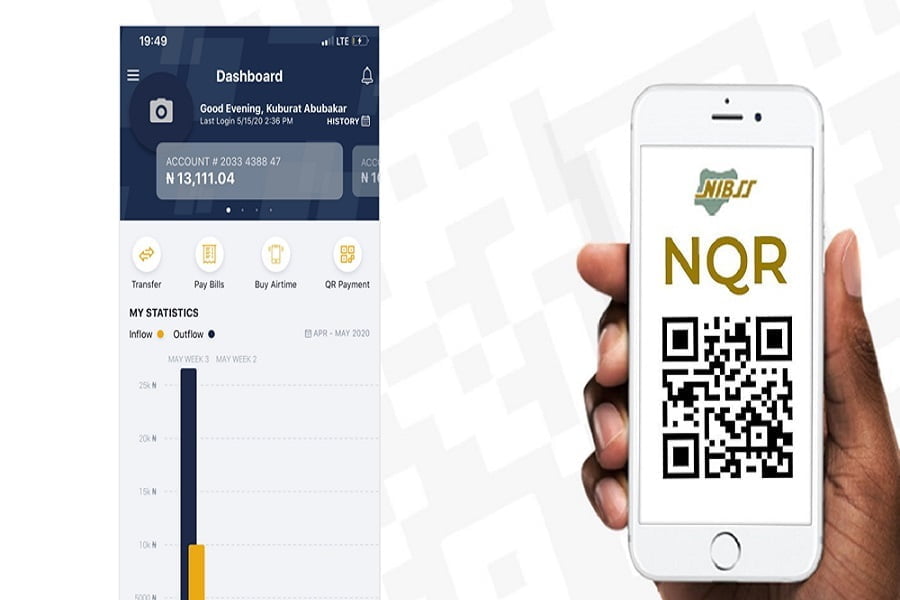

The initiative is accessible on the Bank’s payment infrastructure as the NQR code can be used to make payments through one’s FirstMobile App. And it is also available for the merchant in facilitating their business activities. The touchpoint and use cases of the NQR payment solution include convenience stores, supermarkets, shopping malls, pharmacy, ride-hailing/taxi payments, bus fares, tolling booths payments, vending machines, e-commerce sites, online (Instagram) businesses amongst many others.

To access the service, launch your FirstMobile App and select QR payment. Afterwards, choose NIBSS as a payment provider, then scan the seller’s NQR barcode. Thereafter, the amount is inputted, followed by PIN validation to generate an instant confirmation of the transaction successfully. On the other hand, merchants are to visit any FirstBank branch closest to them for service enrolment.

Speaking on the initiative Dr. Adesola Adeduntan, CEO, FirstBank said “we are delighted with the adoption of the Nigeria Quick Response (NQR) payment solution, an initiative by Nigeria Interbank Settlement System plc (NIBSS) which has been instrumental to easing and promoting payment convenience with the use of mobile phones. At FirstBank, we recognize the indelible role technology plays in promoting businesses across diverse frontiers and we remain committed to reinventing our technology infrastructure to meet global standards whilst being committed to staying true to our mantra in always putting You, our customers First..

FirstBank has been named “Most Valuable Bank Brand in Nigeria” six times in a row (2011 – 2016) by the globally renowned “The Banker Magazine” of the Financial Times Group; “Best Retail Bank in Nigeria” for seven consecutive years (2011 – 2017) by the Asian Banker International Excellence in Retail Financial Services Awards and “Best Bank in Nigeria” by Global Finance for 15 years. Our brand purpose is always to put customers, partners and stakeholders at the heart of our business, even as we standardise customer experience and excellence in financial solutions across sub-Saharan Africa, in consonance with our brand vision “To be the partner of the first choice in building your future”. Our brand promise is always to deliver the ultimate “gold standard” of value and excellence. This commitment is anchored on our inherent values of passion, partnership and people, to position You First in every respect.

Source: nairametrics