In today’s world, the speed and cost of sending money across border as well as the stability of local currency are considered the most critical factors in the entire process of international payment.

Individuals are ditching the conventional methods of international money transfer due to time delays, high processing fees and transaction limits. In Nigeria, many people are switching to cryptos for international remittances as the naira continues to weaken against the US dollar.

Knowing this, Nigerian crypto-based social payments platform, Coins App has set out with a primary focus to simplify cross-border payments through its unique blockchain system.

Cross-Border Payments in a Matter of Seconds

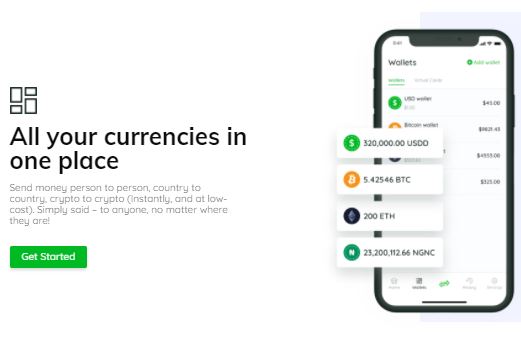

Coins App was launched in July 2020 by Digital Currency Entreprenuer, Daniel Oyekan with the goal of enabling people make faster international transactions at the lowest possible cost. The app, a product of Dan Holdings, also allows users to buy, sell and store cryptocurrencies including Bitcoin, Dollar Stable coin, Naira Stable coin and Ethereum.

In an interview with Technext, Daniel disclosed that the social payments platform is centred around easing international money transfer.

Coins App is a global social payments app that allows anyone to send money from anywhere. The primary use of the app is to allow people move money freely around the world.Daniel Oyekan, Founder and CEO Coins App

Daniel mentioned that the platform has first been introduced to the African market with operations in Nigeria, Ghana, Tanzania, Kenya and Mali. The platform is also expanding to the United States, United Arab Emirates, United Kingdom and some parts of Europe.

Zero Charges on All Transactions

Currently, Coins App charges no fees on payments or trading transactions completed via its platform. Users can send and receive money as well as buy/sell cryptos at absolutely no costs.

Daniel revealed that Coins App does not receive any commission from transactions processed at the moment. He explained that for now, the platform generates its money from foreign exchange rates and third-party payment processing fees.

Nigerians, unsurprisingly, are the biggest users of the Coins App.

Close to 10,000 people have made transactions on the App. They are predominantly Nigerians because we are mostly focused on Nigeria and Ghana for now.Daniel Oyekan, Founder and CEO Coins App

According to Daniel, over $10 million worth of transactions has been processed via the Coins App to date.

First African-owned U.S. Dollar Stable Coin

Coins App offers users the in-demand Dollar pegged Stable coin as one of the cryptocurrencies on its platform. Dollar stable coins are pegged to the US dollar at a 1:1 exchange rate.

Daniel claims the platform is offering the first African-owned US-dollar stable coin.

I don’t think there is any other African-owned US Dollar Stable coin in the market.Daniel Oyekan

Demand for the US dollar stable coin has surged worldwide due to its apparent stability. In Nigeria for instance, due to the Naira’s weakening foreign exchange rate and current volatility, crypto users would rather purchase a Dollar Stable coin for greater security.

Coins App lets users easily buy, sell and store the dollar stable coin.

VISA Virtual Cards to Launch in 2 Weeks

Coins App will soon incorporate virtual cards by world’s leading e-payments provider, VISA.

“We are introducing virtual cards because we want to give people the access to use cryptocurrency to purchase things online,” Daniel stated.

The CEO explained that pending the release of the physical cards, the VISA virtual cards will enable users shop online and make payments on any website including Amazon, Apple, Google and Netflix.

technext