Introduction

As the world of cryptocurrency continues to expand, so does the demand for innovative financial solutions that allow seamless integration of digital assets into everyday transactions. In Nigeria, the adoption of cryptocurrency has been notably enthusiastic, with a growing number of users seeking practical ways to spend their crypto holdings. One such solution is virtual cryptocurrency cards, which provide the convenience of a credit or debit card without the need for a physical card.

Here’s a look at the top 5 best virtual cryptocurrency cards available in Nigeria.

1. Ultima Card by PSTNET

The Ultima Card by PSTNET stands out for its flexibility and user-friendly features.

PSTNET is a company specializing in the issuance of virtual cryptocurrency cards, designed to facilitate any financial transactions. Integrated with the Visa and Mastercard payment system, making PSTNET cards widely accepted globally.

The Ultima Card is an excellent way to utilize cryptocurrency assets in daily life. It imposes no limits on spending or top-ups. According to user reviews, the Ultima Card is ideal as a virtual payment card on popular platforms like PayPal, Steam, Spotify, Netflix, and many others, including various app stores and sales platforms.

This card supports multiple cryptocurrencies, including BTC and USDT, allowing instant loading and spending.

Ultima Card boasts 3D Secure technology support, ensuring enhanced security for transactions. Users appreciate the absence of transaction, declined payment and withdrawal fees, making it a cost-effective choice for frequent users.

Spotlight on the Key Features of the Ultima Card:

- Easy Top-Ups:

Users can top up their card using various methods, including cryptocurrencies like USDT (TRC-20), BTC and over 15 other coins. Bank transfers via SEPA/SWIFT and Visa/Mastercard are also supported

- Low Top Up Commission:

The top-up fee is only 2%. The size of the commission is not affected by the method of deposit or the currency used.

- Simple Registration Process Without Any Documents:

Registration is swift and intuitive, taking just a few minutes. Users can use Google, Telegram, WhatsApp or Apple ID.

Obtaining the first card does not require data verification.

- Discounted Plans:

There are flexible payment plans available, including a significant discount for annual subscriptions. A weekly payment is $7 or an annual plan with a 48% discount, now is $99.

- 24/7 Support:

Customer support is available around the clock via Telegram, WhatsApp and email

PSTNET’s cards offer numerous advantages. All cards are supported by cryptocurrencies and come with favorable terms of use. In addition, besides the Ultima card, PSTNET provides a variety of cards tailored for media buying and financial services for businesses. For instance, brands can create their own payment solution with PSTNET’s White Label cards.

2. Kudi Card by Kudi Exchange

Kudi Cards, offered by famous financial service Kudi Exchange, stand out for their innovative features tailored to meet the needs of modern consumers. Kudi specializes in providing virtual payment solutions, empowering users to seamlessly manage their finances in the digital age. Integrated with the Visa payment system, Kudi Cards are widely accepted globally, ensuring convenience for users worldwide.

Kudi Cards offer a convenient way to utilize cryptocurrency assets in everyday transactions, making them an ideal choice for individuals seeking flexibility and convenience in their financial dealings. With no limits on spending or top-ups, users can enjoy uninterrupted access to their funds, whether making purchases online or in-store.

Key Features of Kudi Cards:

- Flexible Top-Up Options:

With Kudi Cards, topping up your account is quick and convenient. Users can choose from various methods, including cryptocurrencies like BTC, ETH and bank transfers via SEPA/SWIFT.

- Enhanced Security:

Kudi Cards prioritize security with advanced features.

- 24/7 Support

Kudi Cards offers comprehensive technical support to ensure smooth and efficient customer service. Users can access support through various channels, including the Kudi app, Telegram, WhatsApp, and email.

- Simple Registration Process:

To embark on your financial journey with Kudi, start by downloading the Kudi App, available on both iOS and Android platforms. Next, create your account by entering your phone number and email address. Finally, complete the straightforward data verification process by providing a valid ID. With these simple steps, you’ll unlock the full potential of Kudi’s versatile financial services.

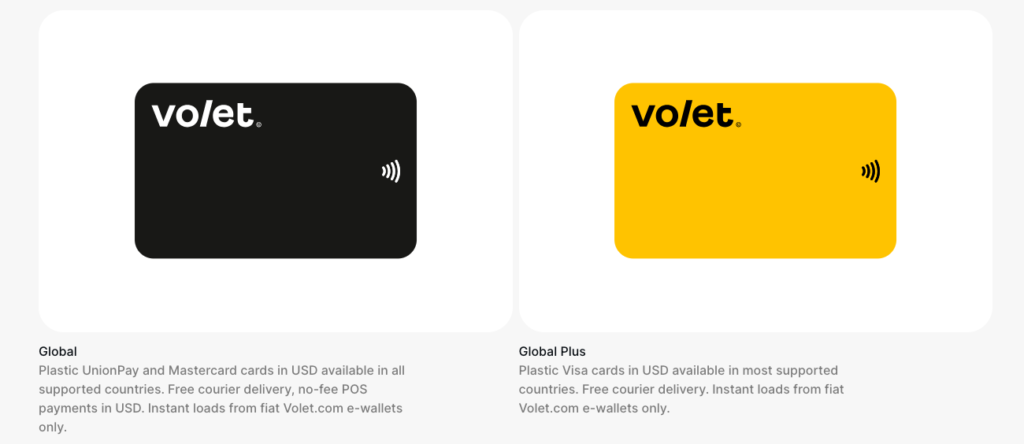

3. The Volet Card by AdvCash

The Volet Card by AdvCash stands out for its versatility and user-centric features. Volet, operating under the AdvCash brand, specializes in issuing virtual and physical cryptocurrency cards designed to facilitate seamless financial transactions. Integrated with Visa and Mastercard payment systems, Volet cards enjoy global acceptance, making them a convenient choice for both local and international use.

The Volet Card is an excellent tool for integrating cryptocurrency into daily financial activities. It imposes no limits on spending or top-ups, which makes it suitable for various uses, from online shopping to travel expenses. Users have praised the Volet Card for its compatibility with popular platforms such as PayPal, Amazon, Netflix, and many others, including app stores and e-commerce sites.

Key Features of Volet Cards:

- Easy Top-Ups:

Users can top up their Volet Card using various methods, including bank transfers via SEPA/SWIFT, Visa/Mastercard transactions, and direct cryptocurrency deposits. The service supports over 15 different cryptocurrencies, including BTC, ETH, LTC, BCH.

- Low Top-Up Fees:

Volet charges a competitive top-up fee of 3.5% for Visa/Mastercard transactions, while cryptocurrency deposits are subject to internal exchange rates. This fee structure is favorable compared to many other financial services.

- Simple Registration Process:

Registering for a Volet Card is straightforward and quick. Users need to sign up on the Volet website, provide basic personal information and complete a simple verification process using a valid ID. This user-friendly registration process ensures that users can start using their Volet Card without unnecessary delays.

- 24/7 Customer Support:

Volet offers round-the-clock customer support via email and chat, ensuring that users can get help whenever they need it. This commitment to customer service underscores Volet’s dedication to providing a reliable and user-friendly experience.

4. Embily

The Embily Crypto Card stands out for its versatility and ease of use, making it a popular choice among cryptocurrency users. Embily, a rapidly growing blockchain payment gateway platform, offers both virtual and plastic debit cards that seamlessly integrate digital and traditional financial systems.

Key Features of Embily Cards:

- Easy Top-Ups:

Users can top up their Embily cards by depositing digital assets into their Embily wallet. The wallet automatically converts these assets into fiat currencies, allowing instant use. Supported cryptocurrencies include BTC, ETH and several others.

- Fee Structure:

Embily maintains a transparent fee structure with competitive rates. While specific fees can vary, typical services like ATM withdrawals and online purchases are often conducted without additional charges, making it a cost-effective option for users.

- Advanced Security:

The Embily cards support 3D Secure technology, enhancing transaction security. Additionally, users can manage their cards through the Embily app.

- 24/7 Customer Support:

Embily offers round-the-clock customer support through various channels, including email and in-app messaging, ensuring that users can get help whenever needed.

5. Crypto Card by BitPay

The Crypto Card by BitPay offers a range of features designed to make spending cryptocurrencies as straightforward as using a traditional debit card. This card allows users to convert their digital assets into fiat currency seamlessly, making it an excellent tool for everyday purchases.

Key Features of BitPay Crypto Cards:

- Wide Cryptocurrency Support:

The BitPay Card supports several cryptocurrencies including BTC, ETH, DOGE, USDC among others. This wide range of supported cryptocurrencies provides flexibility for users to spend their preferred digital assets.

- Global Acceptance:

Integrated with the Mastercard network, the BitPay Card can be used globally wherever Mastercard is accepted. This makes it convenient for international travel and online shopping.

- Easy Top-Ups and Automatic Conversion:

Users can top up their cards via the BitPay Wallet app or their Coinbase account. The card automatically converts selected cryptocurrencies to fiat currency at the time of purchase, streamlining the transaction process.

- Security Features:

The BitPay Card includes advanced security measures such as EMV chip technology and card-locking features, ensuring that user funds are well-protected.

- Cost-Effectiveness:

There are no monthly fees associated with the card. However, it does include a 3% foreign transaction fee and a $2.50 fee for ATM withdrawals. Additionally, an inactivity fee of $5 per month applies after 90 days of no activity.

- Spending and Withdrawal Limits:

The card has a maximum daily spending limit of $10,000 and allows up to three ATM withdrawals per day, with a cap of $2,000 per withdrawal.

Users generally find the BitPay Card to be a practical tool for converting and spending their cryptocurrency.

Conclusion

These five virtual cards offer a range of features and benefits, making them ideal for different types of users in Nigeria. Whether you prioritize low fees, high spending limits, or easy access to customer support, there’s a card on this list to meet your needs. Always consider your specific requirements and usage patterns when selecting the best virtual card for you.